When incorporating a company in India, the Articles of Association (AOA) serve as your company’s internal constitution. Along with the Memorandum of Association (MOA), they collectively form the foundational legal framework that governs how your business operates on a day-to-day basis. In this comprehensive guide, you’ll learn everything that startup founders, accountants, and SMEs need to know about Articles of Association in 2026.

What is Articles of Association?

The articles of association is a legal document that acts as your company’s internal rulebook. Think of it like an operating manual for your business. It’s just as a smartphone comes with instructions on how to use its features, the AOA tells everyone in your company how things should work internally.

For example, if your company were a residential society, the MOA would be the legal document that establishes the society’s existence and defines its core purpose. On the other hand, the Articles of Association would function as the society’s by-laws. In other words, they explain operational rules such as “visitors must register at the gate” or “common area bookings require 48 hours’ notice.”

Key Characteristics:

- Legal Binding: Legally enforceable on company and members

- Internal Focus: Governs internal management, not external dealings

- Mandatory Requirement: Required under Section 5 of Companies Act, 2013

- Amendable: Can be modified through special resolution

- Public Document: Accessible to public through MCA portal

What Do You Mean by Articles of Association?

In practical business terms, the AOA defines the day-to-day operational framework of your company. It establishes:

- How directors are appointed and removed

- Voting rights and procedures

- Share transfer mechanisms

- Meeting protocols (AGM, EGM, Board meetings)

- Dividend distribution policies

- Banking authorities and financial powers

- Dispute resolution procedures

The articles work as a contract between: The company and its members, Members among themselves and the company and its directors.

People also read about 15 Essential Things to Do After Company Registration in India

Importantly, under Section 10 of the Companies Act, 2013, the Articles of Association legally bind the company and its members to the same extent as if they were signed and sealed by each member. However, outsiders such as vendors, banks, and clients are not bound by the AOA’s provisions. That said, they may still examine these articles to understand the company’s internal authority structure and decision-making powers.

What is Memorandum of Association and Articles of Association?

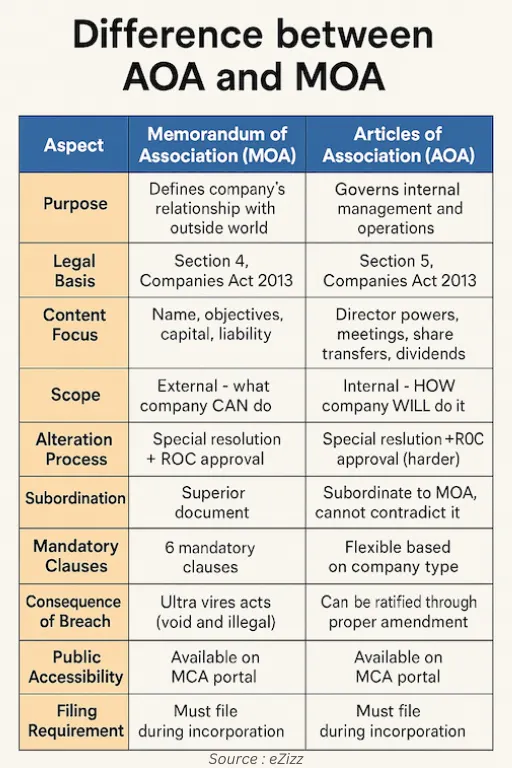

Difference between MOA vs AOA

Critical Relationship: The articles of association cannot contradict or exceed the MOA’s scope. Any AOA provision beyond the MOA is ultra vires (void). For example, if your MOA states “software development” as the business object, your AOA cannot authorize trading in pharmaceuticals.For instance, if your MOA clearly states “software development” as the company’s business object, then the Articles of Association cannot authorize activities such as trading in pharmaceuticals. In short, the AOA must always operate within the boundaries defined by the MOA.

| Aspect | Memorandum of Association (MOA) | Articles of Association (AOA) |

| Purpose | Defines company’s relationship with outside world | Governs internal management and operations |

| Legal Basis | Section 4, Companies Act 2013 | Section 5, Companies Act 2013 |

| Content Focus | Name, objectives, capital, liability | Director powers, meetings, share transfers, dividends |

| Scope | External – what company CAN do | Internal – HOW company WILL do it |

| Alteration Process | Special resolution + ROC approval (harder) | Special resolution + ROC approval (relatively easier) |

| Subordination | Superior document | Subordinate to MOA, cannot contradict it |

| Mandatory Clauses | 6 mandatory clauses | Flexible based on company type |

| Consequences of Breach | Ultra vires acts (void and illegal) | Can be ratified through proper amendment |

| Public Accessibility | Available on MCA portal | Available on MCA portal |

| Filing Requirement | Must file during incorporation | Must file during incorporation |

Sections in Articles of Association

A well-drafted articles of association must cover these essential provisions:

1. Share Capital Management

- Authorized, issued, and subscribed capital details

- Share classes (equity, preference) with rights and limitations

- Share issuance procedures and pricing

- Calls on shares and payment schedules

- Forfeiture procedures for non-payment

- Share transfer and transmission mechanisms

- Lien on shares for unpaid debts

- Share buyback provisions

2. Membership Rights and Obligations

- Criteria for membership admission

- Rights attached to membership (voting, dividends, information access)

- Obligations of members

- Transfer of membership

- Cessation of membership

3. Board of Directors Provisions

- Number of directors (minimum 2 for private, 3 for public)

- Qualifications and disqualifications (Section 164)

- Appointment, retirement by rotation, and removal procedures

- Powers and duties (borrowing limits, asset sale authority)

- Remuneration and sitting fees

- Alternate and additional directors

- Managing director and whole-time director provisions

- Director indemnification

4. General Meetings

- Annual General Meeting (AGM) requirements (Section 96)

- Extraordinary General Meeting (EGM) procedures

- Notice periods (21 days for ordinary, shorter for special business)

- Quorum requirements

- Chairman appointment Virtual/hybrid meeting provisions (added relevance in 2026)

- Recording and minutes (Section 118)

5. Voting Mechanisms

- Voting rights per share class

- Show of hands vs. poll voting

- Proxy voting rules (Section 105)

- Postal ballot and e-voting provisions

- Special resolution requirements (75% majority)

6. Borrowing Powers

- Board’s authority to borrow

- Limits on borrowing (typically up to paid-up capital + free reserves)

- Security creation procedures

- Charge registration requirements

7. Dividends and Reserves

- Dividend declaration procedures (recommendation by Board, approval by shareholders)

- Interim dividend provisions

- Unclaimed dividend management (Section 124)

- Reserve fund creation

8. Accounts, Audit and Disclosure

- Financial year definition (typically April-March)

- Books of accounts maintenance (Section 128)

- Auditor appointment and remuneration (Section 139)

- Financial statement preparation and approval

- Annual return filing (Section 92)

9. Winding Up and Dissolution

- Voluntary winding up procedures

- Distribution of assets

- Liquidator appointment

10. Miscellaneous Provisions

- Common seal usage (optional after 2015 amendment)

- Document authentication

- Registered office and change procedures

- Inspection of registers

- Service of documents

Format of AOA: Detailed Structure and Requirements

The format of AOA under the Companies Act, 2013 must follow these structural requirements:

Standard Format Components:

1. Title Page

ARTICLES OF ASSOCIATION

OF

[COMPANY NAME]PRIVATE LIMITED

(Company Incorporation Number: U74999DL2026PTC123456)

2. Table of Contents

Numbered clauses with descriptions

3. Main Body – Clause-wise Provisions

Interpretation

- Definitions of terms used throughout

- Reference to Companies Act, 2013

Share Capital

- Capital structure details

- Share rights and procedures

Continue with all sections mentioned above

Conclusion

The articles of association forms the backbone of your company’s internal governance. Understanding what is article of association, how it differs from the memorandum, and ensuring proper format of AOA compliance are essential steps in building a legally sound business foundation.

For startup founders and SMEs in 2026, the key is to balance legal compliance with operational flexibility. Don’t just copy-paste templates, customize your AOA to reflect your business model, funding plans, and growth trajectory. Include modern provisions for virtual meetings, clear banking authorities, and founder vesting mechanisms.

Remember the critical relationship: what is memorandum of association and articles of association working together. Simply put, the MOA defines your company’s external boundaries by outlining what the business can do. Meanwhile, the Articles of Association establish the internal rules that explain how those activities will be carried out. Together, these documents ensure both legal clarity and smooth internal governance. Neither document should contradict the other or violate the Companies Act, 2013.

Finally, if you’re a new founder or planning to start a company, eZizz can support you at every step of the journey. In addition, the platform helps with startup discovery, visibility, essential tools, mentorship, and access to India’s growing founder community.

Explore more startup guides and resources at eZizz — India’s launchpad for early founders.