This is a big question that a lot of founders stress over. And honestly, most founders miss a couple of key points when deciding how to split equity.

Your equity split is what’s going to keep your co-founders motivated and committed through the long, tough journey of building a successful company. Many times, co-founders don’t fully understand just how much time and energy they’ll need to pour into the startup if it actually works. As the CEO, you’re the one responsible for figuring out the equity split, and you have to think beyond just what’s fair right now—you have to consider what’s going to keep your co-founders excited about the company in the long run, even if they aren’t thinking about that themselves yet.

One of the biggest mistakes I see is founders saying, “Well, we negotiated this equity split, so that’s what it is.” But that’s not how a great CEO should think. Your first thought shouldn’t be, “What’s the best deal I can get?”—it should be, “What equity split will make my team as motivated as possible?” If you’re worried about giving away too much equity, I get it. Startups break up all the time, and founders leave. But that’s exactly why Cliff Vesting exist.

Vesting and Cliff : Cliff Vesting Your Safety Net

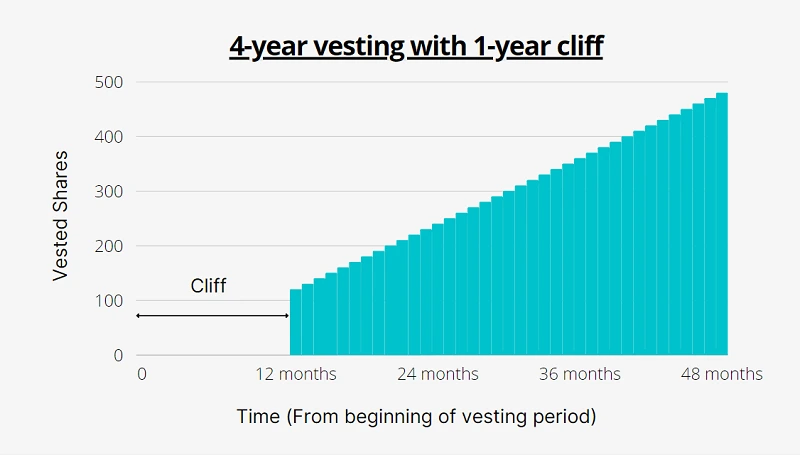

Whenever you give equity to anyone, including your co-founders—you should have a four year vesting schedule with a one year cliff (Cliff Vesting). Here’s what that means:

- Four year vesting: Your Co-founders can only earn your equity by staying with the company for four years. If they leave early, they don’t get your full stake.

- One year cliff: If someone leaves (or gets fired) within the first year, they get nothing.

Cliff Vesting is your trump card in case you realize you picked the wrong co-founder. If you fix the mistake within the asap, there’s no long-term harm to the company. And because you have this safety net in place, it actually makes sense to be more generous with equity, not less.

Why Being Generous with Equity Matters?

The truth is, your co-founders need to feel like owners, not just employees. Their equity stake should be what makes them jump out of bed in the morning, push through the hard times, work late nights, and recruit the best people to join the company.

Startups go through rough patches, every single one does. The last thing you want as a CEO is to constantly have to re-motivate your co-founders. Instead, you want their equity stake to do that for you. If they truly feel like they own a piece of something big, they’ll be willing to put in the extra effort when times get tough.

Should Co-Founders Get Equal Equity Splits?

A lot of people assume that co-founders should get equal equity splits. And in many cases, that works. Equal equity is a simple and fair for everyone. But it’s not always the right move. You have to ask yourself:

- Are all co-founders making equal contributions?

- Are they taking on the same level of risk?

- Will this equity split keep them motivated in the long run?

At the end of the day, if you don’t think a co-founder deserves a meaningful equity stake, you should ask yourself why they’re a co-founder at all. If they’re not worth giving a generous equity grant, maybe they shouldn’t be on your team in the first place.

At the end I would like to summarize it as, Your goal as a CEO is to make sure your co-founders stay motivated for the long haul. Equity is the tool that makes that happen. Cliff Vesting protect the company, so use them wisely—but don’t let fear hold you back from being generous with equity. A well-motivated founding team is the foundation of a successful startup, and getting this right from the start will make all the difference.